Why Switch To Dual Pricing?

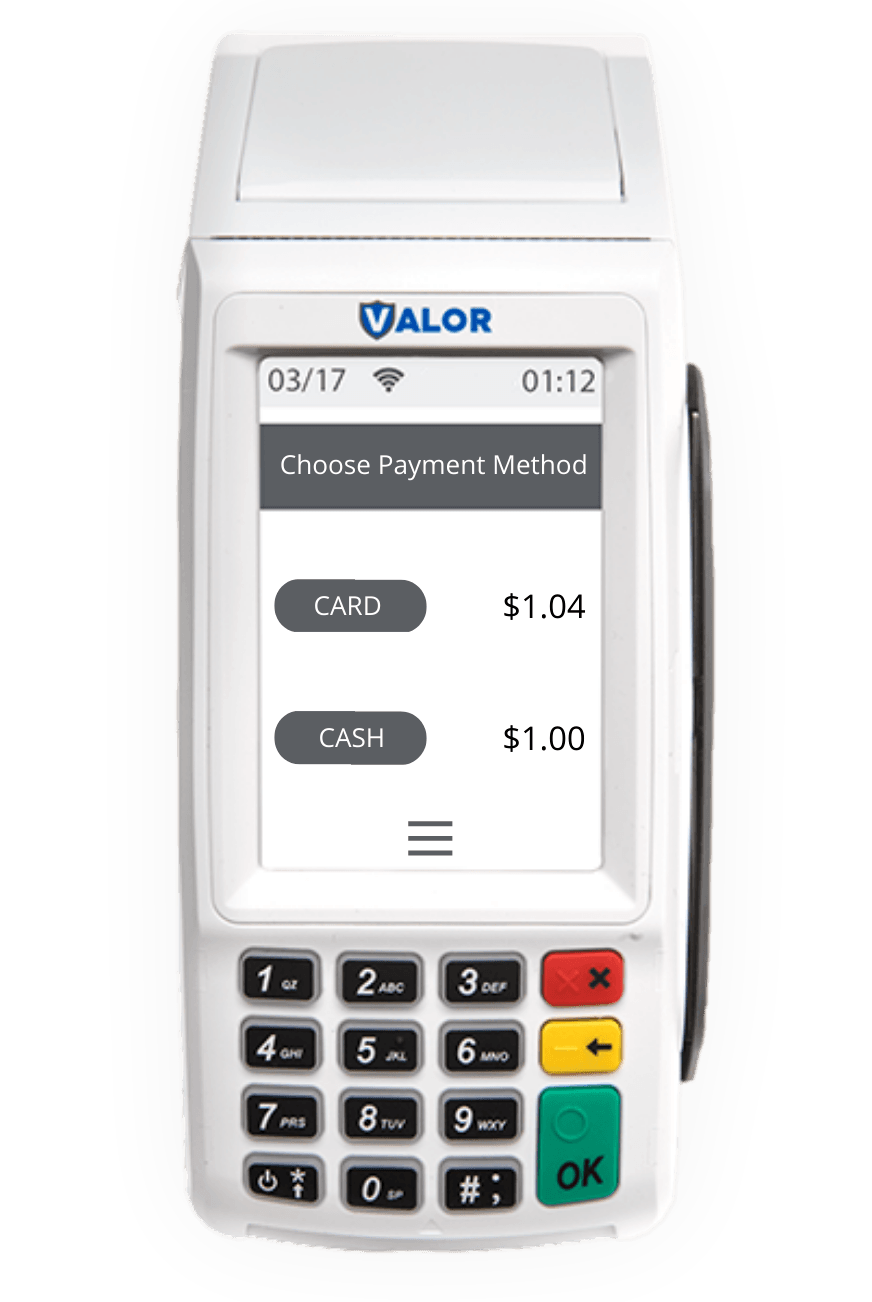

With Financial Business Solutions Group, businesses can now significantly lower or eliminate their merchant processing costs. Our fully compliant program displays dual-pricing on either a terminal or via a virtual gateway, giving the consumer a clear choice for their payment method. The displayed card price includes the cost of payment acceptance.

Program Benefits Include:

- Empower consumers with the choice to select cash or card.

- Eliminate or lower processing costs.

- Choose to pass some or all of the cost of acceptance to the consumer.

- 1 monthly Program fee.

- Available for Invoicing, PayNow, and Virtual Terminal Transactions.

- Low Cost to accept ACH transactions with ACheck21.

Eliminate processing fees with FBSG as your partner!

Until now, true Dual Pricing was not available to most retailers and restaurants due to both limitations of POS software to support dual pricing and the unpredictability of exact payment processing cost on each transaction. Therefore, business owners with many different items or SKU’s could not easily know exactly how to price merchandise under a dual pricing model. More importantly, business owners were unable to offer dual pricing while providing a beautifully transparent and enjoyable customer experience to their valued patrons. All that has changed!

There are a couple of things needed for a business to run a True, Honest and Transparent Dual Pricing Program.

- A business owner willing to take the time and care to present a beautiful customer experience to all of their valued customers. Your customer deserves to know how much each product will cost when they decide to purchase it.

- A merchant services provider who offers a flat rate percentage that aligns with the difference between the regular and cash prices without any additional charges. You need to know your cost on each item in order to price it correctly.

- A POS system capable of supporting a dual pricing model with both a regular price and a cash price for each product or SKU in a business while providing the accurate reporting needed to support the business operations.

Below are two examples of Dual Pricing enabled Terminals: