Clover Point Of Sale Solutions

Most merchants accept credit cards through either terminals or point of sale systems. Whether that means a simple cash register, a cash box or a simple drawer where daily receipts and related paperwork are held throughout the business day. While your point of sale might be simplistic, a robust POS system can help you manage, control and even grow your business in a multitude of ways.

Financial Business Solutions Group is proud to provide our merchants with the leading POS system on the market. The Clover Point of Sale system offers great pricing and payment terms with numerous hardware options that allow us to customize your Point-of-sale system to your unique needs.

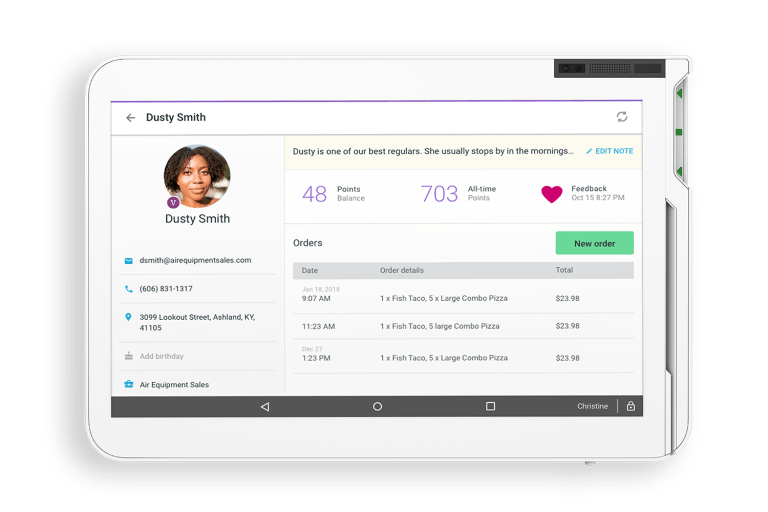

Clover offers a reliable and affordable choice for restaurants, retail outlets and even professional service providers. With user friendly customizable features, no matter what type of industry you serve, Clover makes doing business a breeze for you and your customers while providing you with easy to understand data about inventory control, customer spending habits, peak business times and much more.

For those who don’t currently have a POS system or seek to upgrade to Clover, let's share some basic information. Clover systems are a combination of software and hardware. FBSG will help you choose the perfect hardware configuration for your business. Restaurant servers can beam food orders right from the table to the kitchen using a tablet, or you can set-up a server station where all servers use a single terminal. Incoming orders from Uber Eats, Grubhub, etc. can be sent directly to the kitchen printer freeing up your staff from manually accepting food delivery orders.

Clover includes reporting tools that allow you to track revenue, see your peak volume times, see your best-selling items, get aggregated sales across multiple locations in real-time, produce end-of-day reports that track total sales by employee and so much more. FBSG can help you set up your own custom branded gift card program and can accept gift cards as payment, just like a credit card. If you are using Quickbooks, don’t worry as Clover integrates and shares data with Quickbooks.

Clover can help manage your inventory by alerting you to low stock items. Reports let you know what products are moving the fastest and which products you might want to ditch. You can determine which employees have access to what information through unique logins that allow you to also monitor employee performance. Clover can even help you manage employee scheduling and payroll. Clover truly is the most comprehensive management tool on the market.

For more information about implementing Clover in your business,

contact us today!